An organization uses the bank reconciliation procedure to compare its book balance to the ending cash CARES Act balance in the bank statement provided to it by the company’s bank. In order to arrive at that figure, it is necessary to deduct any outstanding checks or other debits from that balance. Sometimes referred to as a net balance, this figure represents what is left after pending debits have cleared. By allowing for those pending debits, the account holder minimizes the risk of overdrawing the account, incurring penalties, and possibly having a check returned. The book balance is the amount of money tracked in a company’s accounting books. This includes not only the actual cash, but also any checks or deposits that haven’t been processed yet by the bank.

Do you own a business?

The features of book value highlight its role in determining a company’s financial health by reflecting its net asset value, calculated by subtracting liabilities from assets. Take the reins today by making sure your book and bank balance are synced. Stay alert in keeping accurate records and protect your financial future.

Why is Book Balance Important in Accounting?

Book balance and bank balance may differ as book balance includes all recorded transactions, while bank balance only reflects the amount of funds available in a company’s bank account at a specific time. By leveraging accounting software, businesses can streamline the recording and tracking of financial transactions, which in turn facilitates easier reconciliation processes. Placing a strong emphasis on adhering to accounting standards and compliance regulations ensures that the financial data is accurate and meets external reporting requirements. This approach not only improves book balance but also strengthens financial controls and compliance, reducing the risk of errors and inaccuracies in financial reporting. The book balance is derived from a company’s ledger and reflects all financial transactions, including sales, expenses, and any other monetary movements, as recorded by the what is a book balance organization. In contrast, the bank balance is the real-time amount of money held in the company’s bank account.

What is the Difference Between Bank Balance and Book Balance?

Ask a question about your financial situation providing as much detail as possible. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- Ultimately, these challenges highlight the importance of robust systems and processes to ensure the reliability and trustworthiness of financial records.

- The bank balance is the balance reported by the bank on a firm’s bank account at the end of the month.

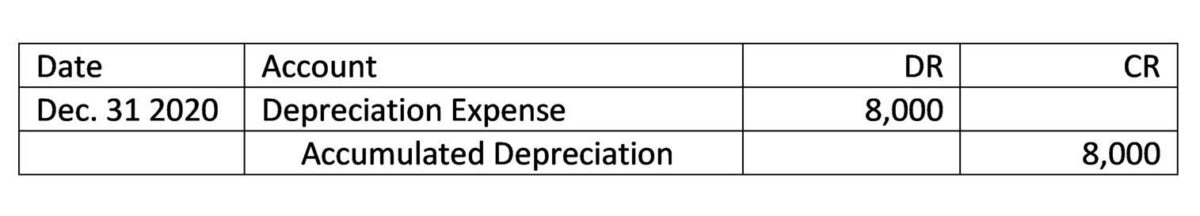

- Accounting entries made at the end of an accounting period to update account balances before preparing financial statements.

- Furthermore, your chances of being approved for a small business loan to fund future expansion are higher if your balance sheet demonstrates that your company’s net worth has increased steadily over time.

- You are currently in the phase of bookkeeping known to accountants as creating a trial balance.

Ask a Financial Professional Any Question

Regular reconciliation helps keep trust with stakeholders and shows commitment to responsible financial management. A company’s bank account may have had account service fees debited out of it during the month and at the end. Until the month-end figures are reconciled with the bank, the debits would not be reflected in the book balance. The cash book balance includes transactions that are not represented in the bank balance. https://www.bookstime.com/ When David deposits money with the bank, he makes an entry on the debit side of his cash book.

It also serves as a key indicator for financial monitoring and the assessment of financial performance, providing stakeholders with confidence in the organization’s stability and prudent financial management. Book value is calculated by subtracting accumulated depreciation from the asset’s original purchase price. Salvage value, also known as residual value, is the estimated amount an asset is expected to fetch at the end of its useful life when it is disposed of or sold. It helps determine the depreciation expense for an asset over its lifespan. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

How Can a Company Improve its Book Balance?

The main drawback is the potential for human error in recording transactions, which can lead to discrepancies and inconsistencies. The need for regular reconciliation can be time-consuming and resource-intensive, adding complexity to financial processes. An illustrative example of book balance calculation involves the aggregation of all credit and debit transactions, followed by adjustments for accruals and reconciling items to derive the final book balance. A negative book balance indicates a deficit or overdraft situation, necessitating immediate attention to address financial oversight and regulatory compliance. Book balance can be categorized into positive book balance, indicating a surplus of funds, and negative book balance, signifying a deficit or overdraft situation. Understanding the interplay of assets, liabilities, and equity is crucial for investors, creditors, and management in making informed decisions.

On the bank’s side, the record is usually kept in the form of a personal account. It is maintained more or less along the same lines as a businessperson maintains their personal accounts for debtors and creditors. Now, the only thing left to do after loading the data is to go through the entries and make sure each one is categorized appropriately. This procedure is made simple and effective by maintaining a separate business bank account.