All of our content is based on objective analysis, and the opinions are our own. Nevertheless, on 5 June, when the bank pays the check, the difference will cease to exist. Therefore, such adjustment procedures help in determining the balance as per the bank that will go into the balance sheet. The items shown in the book section arise from the previously unknown events. On the other hand, if the deposit was made earlier, it would be essential to determine why it hadn’t been received.

Transposition error

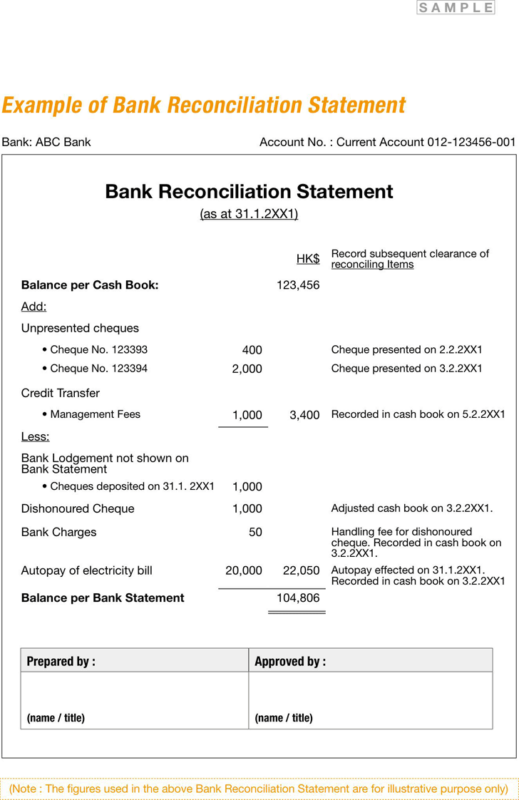

When you compare the balance of your cash book with the balance showcased by your bank passbook, there is often a difference. One of the primary reasons this happens is due to the time delay in recording the transactions of either payments or receipts. The purpose of preparing a bank reconciliation statement is to reconcile the difference between the balance as per the cash book and the balance as per the passbook. NSF checks are an item to be reconciled when preparing the bank reconciliation statement, because when you deposit a check, often it has already been cleared by the bank. But this is not the case as the bank does not clear an NFS check, and as a result, the cash on hand balance gets reduced.

Bank Service Charge

An inquiry should also be made concerning the lack of notification about the NSF check. Customer check of $1,250 deposited by Company A has been returned and charged back as NSF (not sufficient funds). However, you typically only have a limited period, such as 30 days from the statement date, to catch and request correction of errors. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Bank Reconciliation Process: Explanation

It’s a tool for understanding your company’s cash flow and managing accounts payable and receivable. If you haven’t been using bank reconciliation statements, now is the best time to start. Today, online banking and accounting software offer real-time feeds and automated transaction matching.

- The bank statement submitted by the businessman at the end of May will not contain an entry for the check, whereas the cash book will have the entry.

- Regular bank reconciliation double-checks that all payments have been accurately processed.

- We’ll explore the definition of bank reconciliation, why it’s important, and a step-by-step process for performing bank reconciliations.

- That’s to say, an entry is made in the bank column on the debit side of the cash book.

- Bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections.

Would you prefer to work with a financial professional remotely or in-person?

After identifying the reasons your bank statement doesn’t match accounting records, you have to update your records. If the bank has made errors, notify them so that they correct the transactions. The company reflected the payment it received from debtors in its cashbook, but the payment hasn’t yet reflected in the bank account. The account holder is responsible for preparing a bank reconciliation to identify differences between the cash balance and the bank statements. Keeping accurate records of your bank transactions can help you determine your financial health and avoid costly fees.

Since the notification had not been received, it was necessary to put this item on the reconciliation. If the deposit was made toward the end of the month, there would be no need to notify the bank. Our writers and editors used an in-house natural language generation platform to assist with portions of this article, states with no income tax allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication. We offer reconciliation reports, discrepancy identification, and live accountants to work with for ease and confidence when closing your books.

Once you complete the bank reconciliation statement at the end of the month, you need to print the bank reconciliation report and keep it in your monthly journal entries as a separate document. This document will make auditors aware of the reconciled information at a later date. When your business issues a check to suppliers or creditors, these amounts are immediately recorded on the credit side of your cash book. However, there might be a situation where the receiving entity may not present the checks issued by your business to the bank for immediate payment. These fees are charged to your account directly, and reduce the reflected bank balance in your bank statement. These charges won’t be recorded by your business until your bank provides you with the bank statement at the end of every month.

This relatively straightforward and quick process provides a clear picture of your financial health. Consider reconciling your bank account monthly, whether you set aside a specific day each month or do it as your statements arrive. As with deposits, take time to compare your personal records to the bank statement to ensure that every withdrawal, big or small, is accounted for on both records. If you’re missing transactions in your personal records, add them and deduct the amount from your balance. If you’re finding withdrawals that aren’t listed on the bank statement, do some investigation. If it’s a missing check withdrawal, it’s possible that it hasn’t been cashed yet or wasn’t cashed by the statement deadline.

This may occur if you were subject to any fees, like a monthly maintenance fee or overdraft fee. For interest-bearing accounts, a bank adjustment could be the amount of interest you earned over the statement period. Find all checks that you have issued but have not been presented for payment. You can do so by comparing the checks issued in your accounting record with the checks honored as per your bank statement.

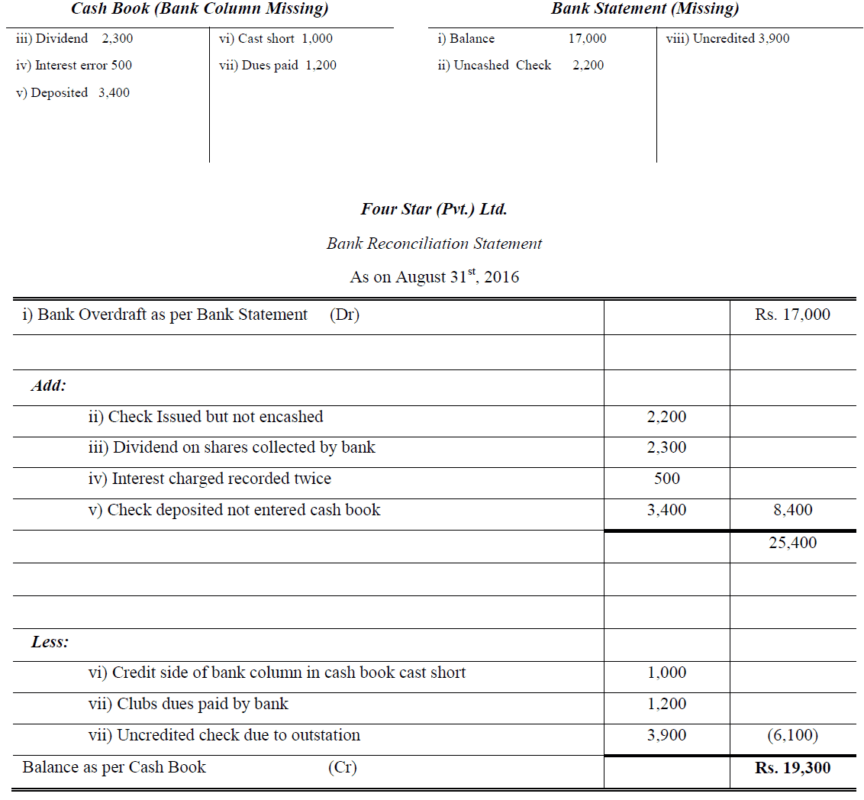

This often happens when the checks are written in the last few days of the month. To reconcile means to “make one view or belief compatible with another.” In accounting, that means making your account balances equal to one another. More specifically, a bank reconciliation means balancing your bank statements with your bookkeeping. As of 30 September 20XX, the ending debit cash balance in the accounting records of Company A was $1,500, whereas its bank account showed an overdraft of $500.