There may be a large number of entries into this journal, depending on the frequency of cash receipts from customers. Read on as we take a closer look at what a cash receipts journal is, the different types, and the pros and cons. You must be able to substantiate certain elements of expenses to deduct them on your tax return. Cash Basis Accounting is a type of accounting whereby all of the company’s revenues are recognised upon actual cash receipt and all of the expenses are recognised upon payment. It also ensures that the business can keep track of all the account receivables and aged receivables.

Get in Touch With a Financial Advisor

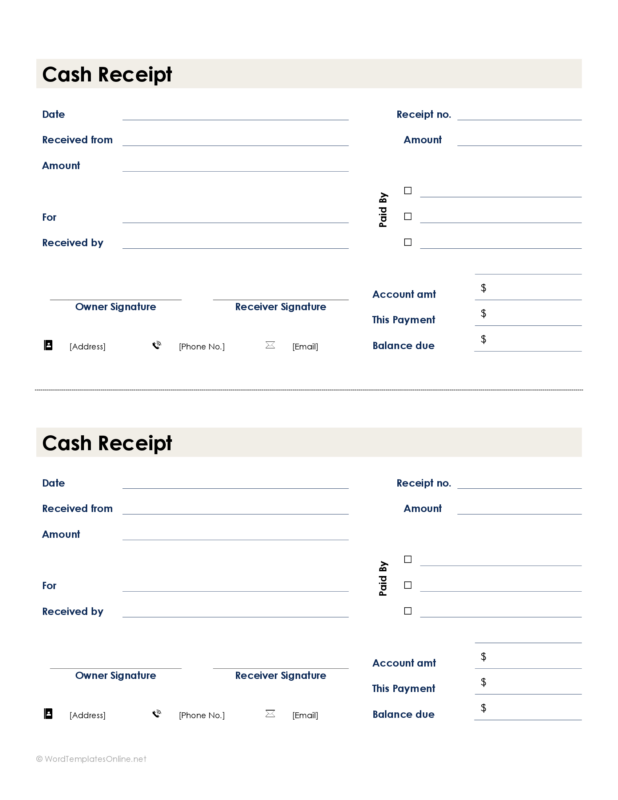

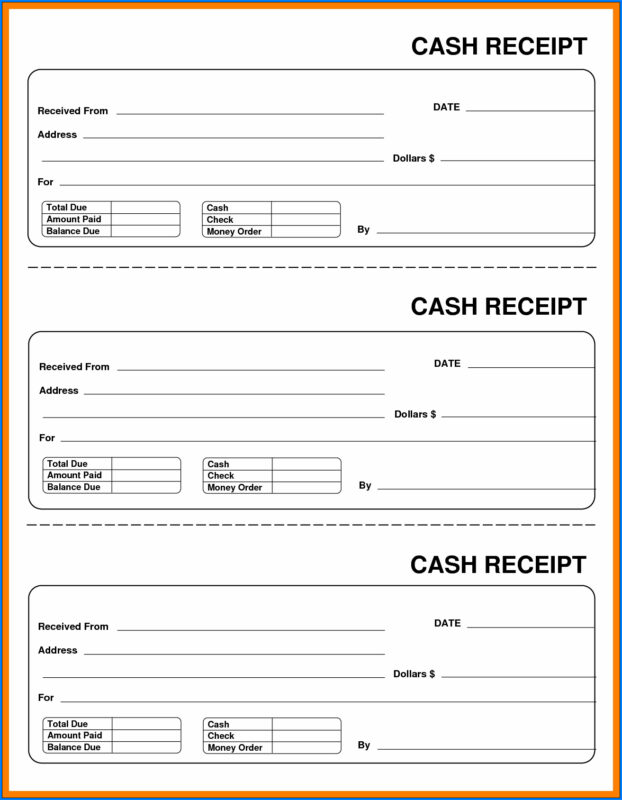

The debit columns in a cash receipts journal will always include a cash column and, most likely, a sales discount column. Other debit columns may be used if the firm routinely engages in a particular transaction. This format in effect combines both two column formats discussed above in that it uses the additional columns to record both discounts and bank account transactions. The first three columns in the diagram are the date, transaction description (Desc.), and ledger folio reference (LF). The single column referred to in the name of this cash ledger book is the monetary amount of the cash receipt (Cash) highlighted in gray. The cash receipts journal is that type of accounting journal that is only used to record all cash receipts during an accounting period and works on the golden rule of accounting – debit what comes in and credits what goes out.

New York LawsRPP – Real PropertyArticle 7 – Landlord and Tenant235-E – Duty of Landlord to Provide Written Receipt.

- This ensures that the individual customers’ accounts are up to date and accurately reflect the balance owed at that date.

- Credit sales are handled using the accrual basis of accounting, while cash transactions are handled using the cash basis.

- The cash receipts journal is used to record all transactions that result in the receipt of cash.

- In this example, the cash receipts journal records the cash inflows received by the business during June.

The cash receipt journal has many advantages about its use within regular business accounting methods. A cash receipts journal provides an easy and organized way to record all the cash receipts during the period. Therefore, it allows a quicker and accurate way to prepare the cash ledger and a cash flow statement for the business for an accounting period. Credit sales are not recorded in this accounting journal because there isn’t any cash collected in those credit sales transactions.

Balance Sheet

Keep in mind that your entries will vary if you offer store credit or if customers use a combination of payment methods (e.g., part cash and credit). And, enter the cash transaction in your sales journal or accounts receivable ledger. The credit sales which the busy ones make are not recorded in the cash journal as no cash is received while these sales transactions occur. Cash sales, on the other hand on a cash basis of accounting and therefore are recorded in the cash journal.

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Ask a question about your financial situation providing as much detail as possible.

Which of these is most important for your financial advisor to have?

One of the journals is a cash receipts journal, a record of all of the cash that a business takes in. You may sell items or provide services that people pay for with cash, which may range from food or books to massages or even a ride in a taxicab. SequentiallyAccount-wiseDebit and CreditColumnsSidesNarrationMustNot necessary.BalancingNeed not to be balanced.Must be balanced.

Cost of goods sold is debited for the price the company paid for the inventory and the inventory account is credited for the same price. It differs from the cash receipts journal in that the latter will serve to book sales when cash is received.The sales journal is used to record all of the company sales on credit. A cash receipts journal is a record of financial transactions that includes bank deposits and withdrawals as well as all cash payments and receipts. The general ledger account is then updated with the cash receipts journal entries.

In addition, the post reference “cr” is recorded to indicate that these entries came from the of the bankruptcy. Again, in the general ledger accounts, the post reference “CR-8” is recorded to indicate that these entries came from page 8 of the cash receipts journal. At the end of the month, the different columns in the cash receipts journal are totaled. The totals from all the amount columns (other than the other account column) are posted to the appropriate general ledger accounts.

A column for the transaction date, account name or customer name, invoice number, posting check box, accounts receivable amount, and cost of goods sold amount. Since all sales recorded in the sales journal are paid on credit, there is no need for a cash column. A common error made when posting entries from a cash receipts journal is to forget to post the individual amounts in the accounts receivable column to the subsidiary ledger accounts receivable.

The cash book is a chronological record of the receipts and payments transactions for a business. A special journal (or specialized journal) used to record money received. In a manual systemthis will allow one entry to the Cash account for the month (or shorter periods) instead ofdebiting the Cash account for every receipt.